Join Our Club

About Our Investment Club

ECU Investment Club was founded in 2012; in 2025 it received a major rebrand. Meetings are held weekly where we go over and teach financial analysis, valuation, modeling, market concepts, and interview training. We meet in the Bate building in either room 1031. We bring in amazing speakers from around the nation in sectors such as Investment banking, Wealth management, private equity, hedge funds, consulting, accounting, and more that give valuable insights and lessons that help shape the perspective and growth of our members. Also, during our weekly meetings, members receive premium market updates and the ability to practice underwriting on securities that may have potential.

With over 150 active members and a consistent track record of great speakers and opportunities, we’ve established ourselves as a premier investment education organization. Our alumni have gone on to have successful careers in finance, consulting, and entrepreneurship.

Through our resources, ECU Investment Club funds learning opportunities and initiatives such as trips to New York and Charlotte, through challenges that pay cash prizes such as the pirate trading challenge and more. But even with all of this, ECU Investment Club is more than just a financial education organization; it is a community of people who have bonded over their same love and passion for the world of finance. It is where students find a belonging and relations that last far longer than a university.

Support Our Mission

Help us continue providing exceptional investment education and opportunities to the next generation of financial leaders

Educational Trips

Experience the financial industry firsthand with our Miami trip (Feb 4-7). Visit top financial institutions, meet industry leaders, and network with 60 students from Investment Club, Women in Business, and FMA. Gain exposure to wealth management, investment banking, and trading in a global business hub.

Business Experiences

Connect with 10-15 industry professionals throughout the year. Attend exclusive speaker series, networking events, and workshops covering equity research, derivatives, and corporate finance. Build relationships that lead to internships and career opportunities while developing technical skills for job interviews.

Pirate Trade Challenge

Compete in our annual stock trading competition with $300,000 in prop money on Webull. Teams of 3 trade equities, options, and shorts with strategic position limits. Winners receive $1,000 cash and a mystery Spring 2026 opportunity. Test your skills against the executive board and fellow members.

Your contribution directly funds these transformative experiences and helps build the next generation of ethical, knowledgeable investors.

Upcoming Events Calendar

Stay updated with our meetings, workshops, and networking events

Blacksail x FMA x IC

11Intro Meeting

16Speaker Preparation

23Guest Speaker

30Guest Speaker

7Meeting

21Meeting

30Meeting

4Meeting

11Meeting

13Meeting

18Previous Presentations

Explore our educational sessions, investment pitches, and market analysis presentations

Welcome to Investment Club

Introduction to the Investment Club covering stock market overview, lessons on equities, bonds, crypto, and real estate. Announced the Freshman Exec-Intern program, Charlotte trip with FMA, and the Stock Challenge with $300,000 in prop money. Detailed weekly meetings, speaker series, and networking opportunities.

Silver: The Safe Haven of the Stock Market

Comprehensive analysis of silver as an investment vehicle. Covered silver vs gold comparison, trading mechanisms (/SI futures, SLV ETF, mining companies), safe haven characteristics during war and recessions, supply/demand dynamics, and investment opportunities in SLV and SIL ETFs with technical analysis.

Nike Investment Analysis

Deep dive into Nike's corporate structure, leadership transition from John Donahue to Elliott Hill, product line analysis, geographical breakdown, and financial ratios. Examined Nike's DTC strategy failures, factory placement across 40 countries, earnings history, and investor sentiment. Discussed sandbagging tactics and provided technical analysis with a fair price target of $75.

Crude Oil Trading & OPEC Reports

Educational session on trading crude oil using technicals, news, and supply/demand analysis. Covered OPEC report interpretation, SMA 20/50/200 indicators, Fibonacci retracements, short-to-long ratios, and geopolitical climate impacts (Russia-Ukraine, Israel-Palestine). Discussed oil volatility (OVX), position sizing strategies, and stop loss placement.

What Moves Markets

Comprehensive overview of market-moving factors including interest rate decisions, economic reports (CPI, GDP, PMI), earnings reports, and investor relations. Taught members how to classify stocks by size (small/mid/large cap) and sector, interpret economic calendars, analyze earnings calls, and use momentum and technical indicators for trading decisions.

ECU Investment Club: Experiencing the Financial Capital of the South

The East Carolina University Investment Club is giving more than 60 College of Business students an incredible chance to see what the financial industry is really like through a four-day trip to Miami, Florida, often called the "Wall Street of the South." Miami is home to over 60 international banks and major companies such as Citadel, Carnival Cruise Lines, and Goldman Sachs, making it a key gateway to the global economy and a major center for corporate finance.

Each day of the trip will be filled with hands-on experiences designed to help students connect what they've learned in class to real-world finance and accounting. They'll meet with corporate finance executives, take part in professional dinners in Brickell the heart of Miami's financial district and learn how the city serves as both the Port of the Americas and a growing hub for international trade and investment.

Students from the Investment Club, Women in Business, and the Financial Management Association will all take part, creating a group of over 60 participants who will gain valuable networking experience. The trip will expose students to different areas of high finance, including wealth management, investment banking, and trading, while also helping them build stronger connections with ECU alumni and top industry professionals.

Beyond networking, this trip shows ECU's ongoing commitment to helping students succeed after graduation by strengthening their professional skills and aligning classroom learning with real industry needs. Through direct interaction with finance leaders and exposure to leading firms, students will gain the confidence, global perspective, and practical knowledge needed to launch successful financial careers.

The experience also promotes diversity and inclusion by supporting underrepresented students and encouraging meaningful connections with employers. It helps build partnerships that benefit both students and the university. With Miami's financial sector growing at about 3% each year and its standing as the second-largest U.S. city for international banking, this trip offers a front-row seat to one of the fastest-growing financial markets in the country.

By linking academic learning with real-world experience, the ECU Investment Club's Miami trip helps students bridge the gap between the classroom and the corporate world empowering them to take charge of their futures in global finance. The ECU Investment Club is looking for any prospective employees.

Meet the Executive Board

Our dedicated leadership team brings diverse expertise and passion for investment education

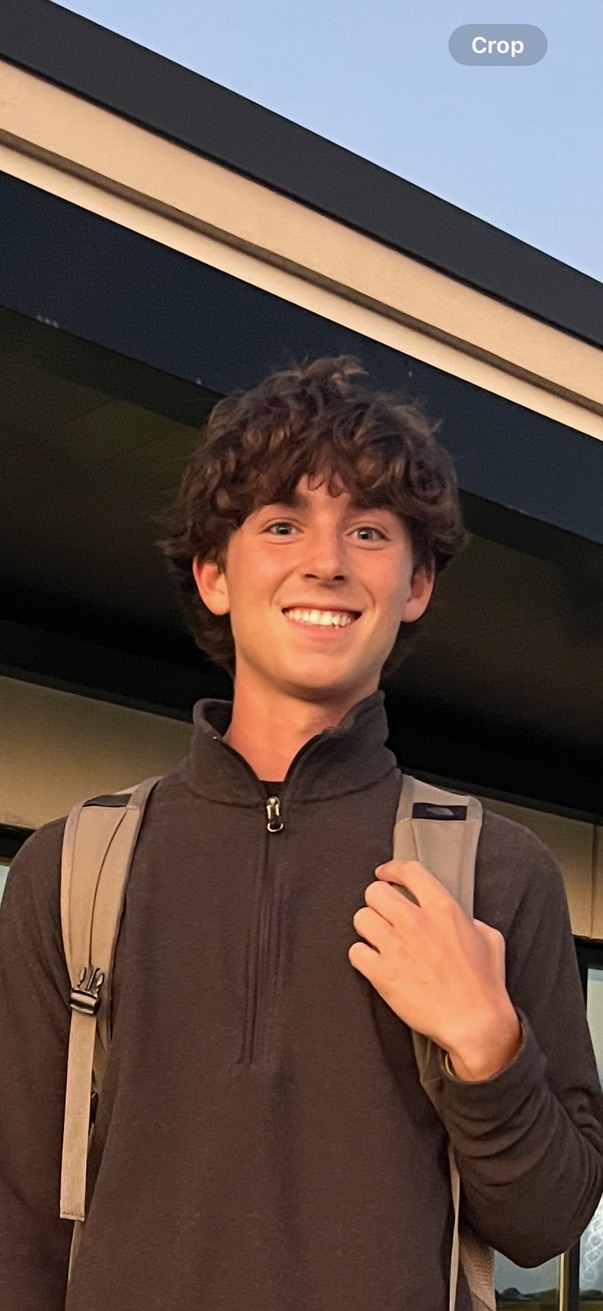

Christian Vito

Christian serves as Blacksail VP overseeing Healthcare, Defense, Real-estate, Infrastructure, and Materials sectors. As Investment Club Co-President, he has overseen student success in the club setting and serves as Principal of FinCon #2 for 2026 alongside Garrison Miller.

Luke Hansen

Luke is a driven finance professional pursuing a BSBA in Finance at ECU. As Head of Energy Markets and Trading at Blacksail Fund, he manages a team of analysts and associates while leading underwriting decisions across power generation and energy-focused holdings. He also trades independently in equities and options, focusing on derivatives strategies around IPO structures. As Co-President of ECU's Investment Club, he has scaled membership to over 100 students and launched the school's first-ever trading challenge.

Yahir Flores

Yahir is a Finance and Accounting major at ECU with an emphasis on finance, serving as Chief of Operations for the Investment Club. He brings strong leadership and organizational skills from his role as a restaurant manager and two years of experience as an IT specialist. Driven by growth, efficiency, and making a meaningful impact, Yahir is passionate about fitness and cooking outside of academics.

Brady Weller

Brady has over four years of market experience and holds extensive knowledge in derivatives. He leads the club's marketing initiatives and supports members in developing practical investing and risk management skills.

Coyle Garcia

Coyle is a sophomore at ECU studying Finance, serving as Senior Analyst directing Market Research for the Investment Club. He is currently an investment banking intern at Highlands Capital Advisors, gaining hands-on experience in financial analysis and deal execution.

Mar Moore

Mar is a sophomore triple majoring in Finance, Accounting, and Economics at ECU. As Senior Analyst for the Investment Club, he analyzes companies, markets, and financial data to provide insights and help the club make informed investment decisions on valuation. He is looking to break into investment banking.

Brandon Betances

Brandon is a junior at ECU majoring in Finance and Risk Management & Insurance, with a strong interest in pursuing a career in risk management. He is Treasurer of the Investment Club and a dedicated member of Gamma Iota Sigma, the Financial Management Association, and ALPFA.

Giovanni Gonzalez

Giovanni is a freshman at ECU and part of the treasury department in the Investment Club. He collects and tracks group dues using Excel to maintain accurate financial records, manages Venmo payments and efficiently reconciles transactions to ensure financial integrity, and assists in budgeting and planning for club trips and activities to enhance member participation and cost-effectiveness.

Astrid Castro

Astrid formulates schedules and event calendars while managing the club's social media platforms. She oversees recruitment and membership initiatives, ensuring strong engagement and growth for the Investment Club.

Halleigh Keldorph

Halleigh is a Junior at ECU studying Finance, serving as an Analyst for the Investment Club. She analyzes market news to keep the club informed and updated on the current news for investment decisions.

Ethan Petty

Ethan is a freshman Capital Foundations Intern contributing to long-term planning for club growth and member engagement. He assists in developing educational material for club meetings and serves as an Analyst for the Blacksail Fund, currently working on his Bloomberg Market Concept certificate.

Kade Slaughter

Kade is a first-year student at ECU double majoring in Finance and Accounting. He shadows senior members of the Investment Club, training to fill their shoes. Kade assists in getting guest speakers to events and researches market news to help the club stay informed. He hopes to receive his CPA license and work in audit.